With U.S. unemployment rates at historic highs, we wondered, how is this impacting the residential rental market? To find out what effect the pandemic is having on the residential rental market, Spirited commissioned the 2020 Effects of the COVID-19 Pandemic on Residential Rentals Survey.

This survey focuses on financial document application fraud (altered bank statements, fake pay stubs, etc.) and the connection to evictions within rental portfolios. We surveyed property managers who either manage or are directly involved with evaluating rental applications and renters split among Millennials, Gen-Xers, Boomers and the Silent Generation.

Key Survey Finding

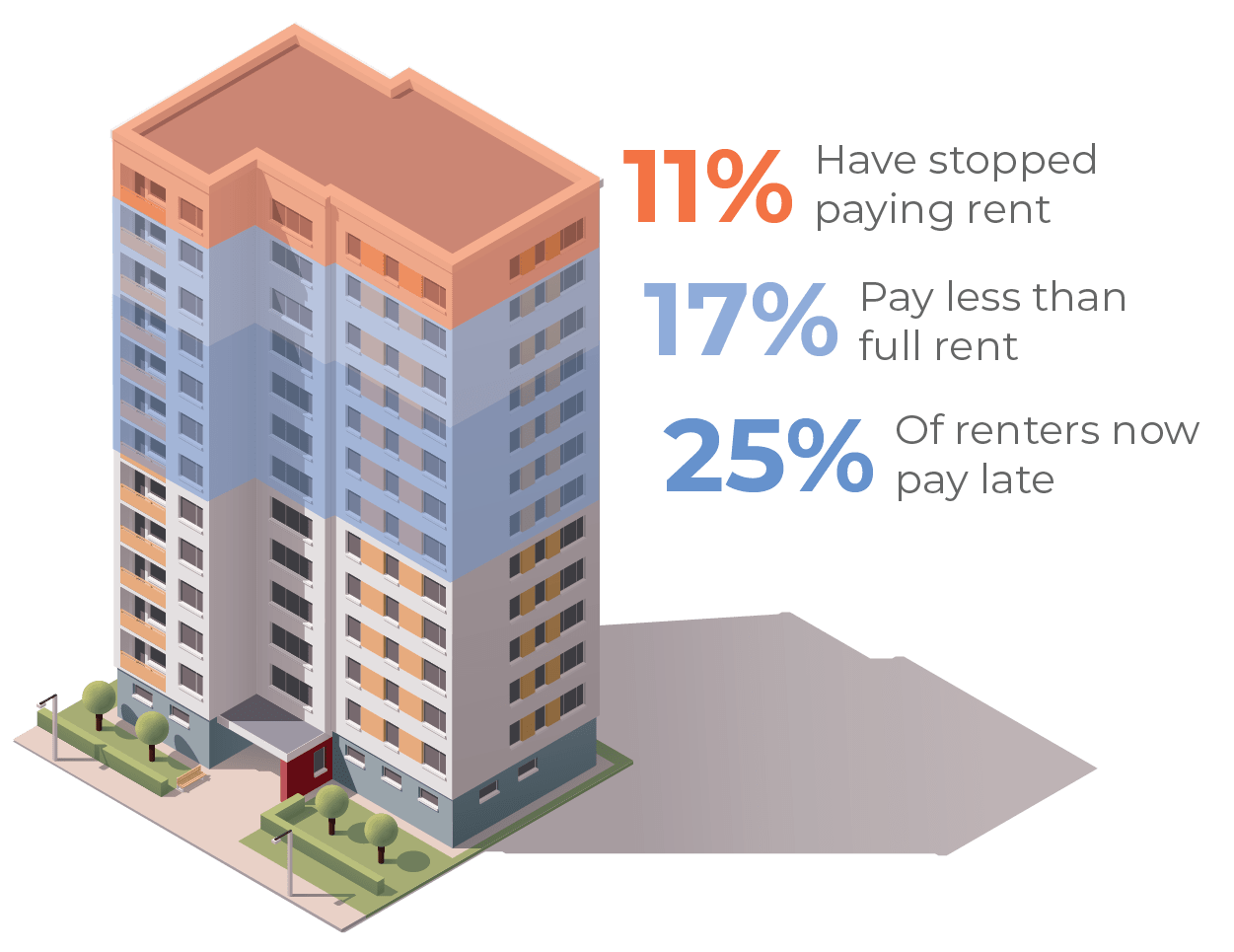

Property Managers report that 53% of tenants are having trouble making rent. In fact, 25% of tenants are paying late, 17% now pay less than full rent, and 11% have stopped paying at all. Additionally, the number of renters paying rent by credit card is soaring. Is this an indicator that these renters are near the end of their financial ropes?

Property Managers report an astounding 21% eviction rate today, a 75% increase from last year. One in four of these are tied to application fraud. Three of ten renters have been or will be evicted after moratoriums expire. In fact, the typical property manager has 15 evictions stacked up waiting for moratoriums to expire.

Key Survey Finding

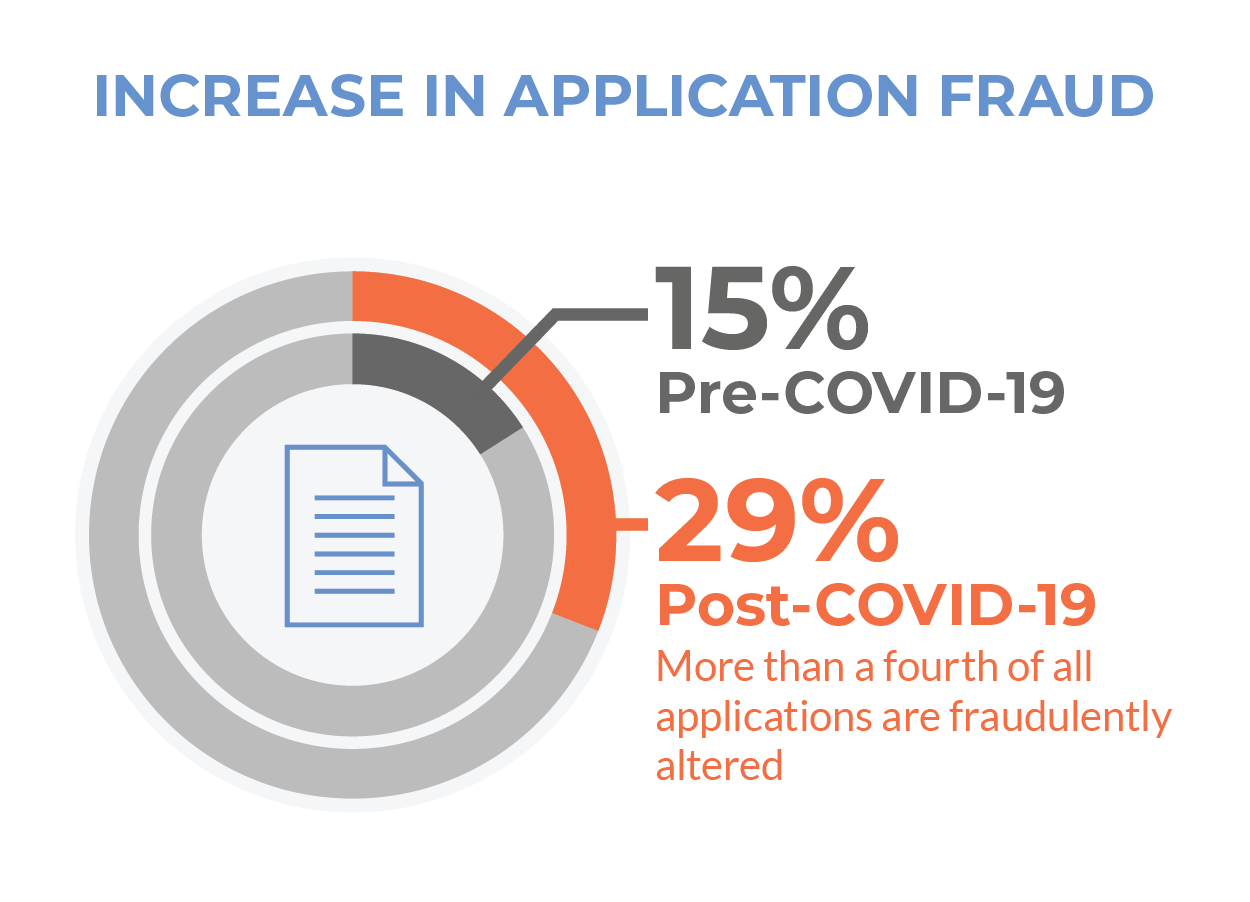

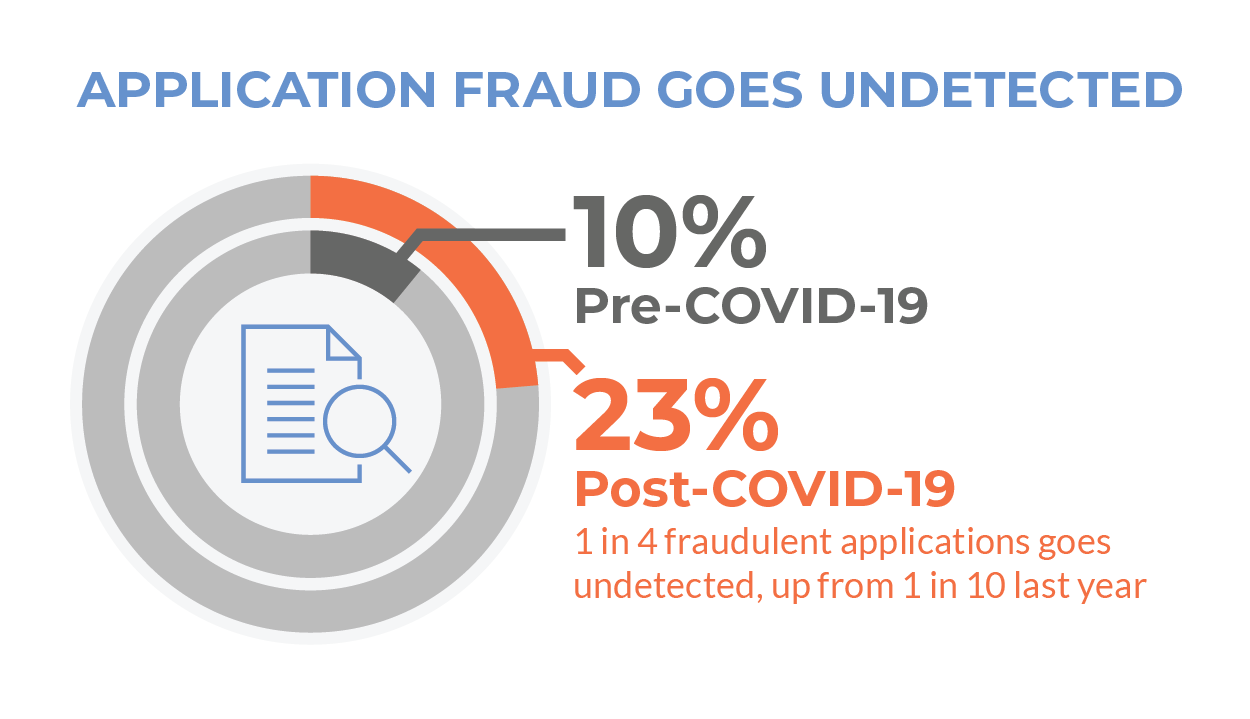

Did you know that more than a fourth of the financial documentation within rental applications are fraudulently altered? This includes fake pay stubs, altered employment records, and other financial documents are being falsely presented as legitimate during the rental applications process. These types of financial document fraud a difficult to detect, especially when submitted via an online application.

Altering application documents is easy with everyday technology like high-quality scanners and photo-editing software. Although it's easy to commit, it's difficult to detect. Unfortunately, this leads to applications with inaccurate information which makes tenant screening riskier than ever before.

Yes. Property managers can employ a combination of tenant screening best practices combined with affordable technology to stay a step ahead of even the most sophisticated fraudsters and protect their portfolios from losses in these difficult times.

Is the visual quality of every document what you would expect? Or, does it look like

it has been copied multiple times? Ensure account numbers carry across separate

documents. Check that transactional details and other numbers are aligned and match

formatting in verified documents you’ve received from the same source in the past.

Call all the telephone numbers on a document to make sure they work; but, how do you

know the person on the line is a prior employer or an accomplice in crime? Look up contact information for issuing organizations or corporate HR departments yourself. Ask for details such as a start-date, specific information a friend would be unlikely to know.

Does the narrative across all sources of an application agree? Inconsistencies or

dead links for live documents are a red flag. How do applicants feel about submitting

paperwork in person? Peruse LinkedIn pages and review histories through online

databases such as sba.gov or opencorporates.com to ensure a company is legitimate.

Ask applicants to print statements in the leasing office.

In addition to the previous techniques, many property managers are turning to

technology solutions. New tools allow for programmatic evaluation of tenants and

identification of fraudulent documents to prevent a fraudulent tenant from ever

signing a lease.

©2022 Spirited. All rights reserved.