The combination of online applications, paystub generation websites, and a recessed economy made 2020 a record year for financial document fraud in rental applications. In fact, Spirited recently analyzed application documentation for over 15,000 rental applications in 2020. On average, our customers saw a 14% fraud rate, and in the residential market – fraud leads to evictions.

Spirited has been catching fraudsters and compiling fraud rates in the residential industry for years. Here’s what we’ve learned.

Tips for spotting fake paystubs:

- Fake Paystubs are easy to generate

There are many websites that make creating fake pay stubs in minutes. These pay stubs look legitimate and are nearly indistinguishable from a real pay stub. Scammers can enter any information they want to fraudulently qualify for a rental, opening up the property to risk – financially and reputationally. - Call their employer

A quick way to filter out scammers is to ask them for permission to call their employer. Their reaction can give you the first clues as to whether the pay stub is real or not. And don't call the number they provide. They may have asked a friend to pretend to be their employer. Research the company and call them directly. - Cross-check the pay stub with a bank statement

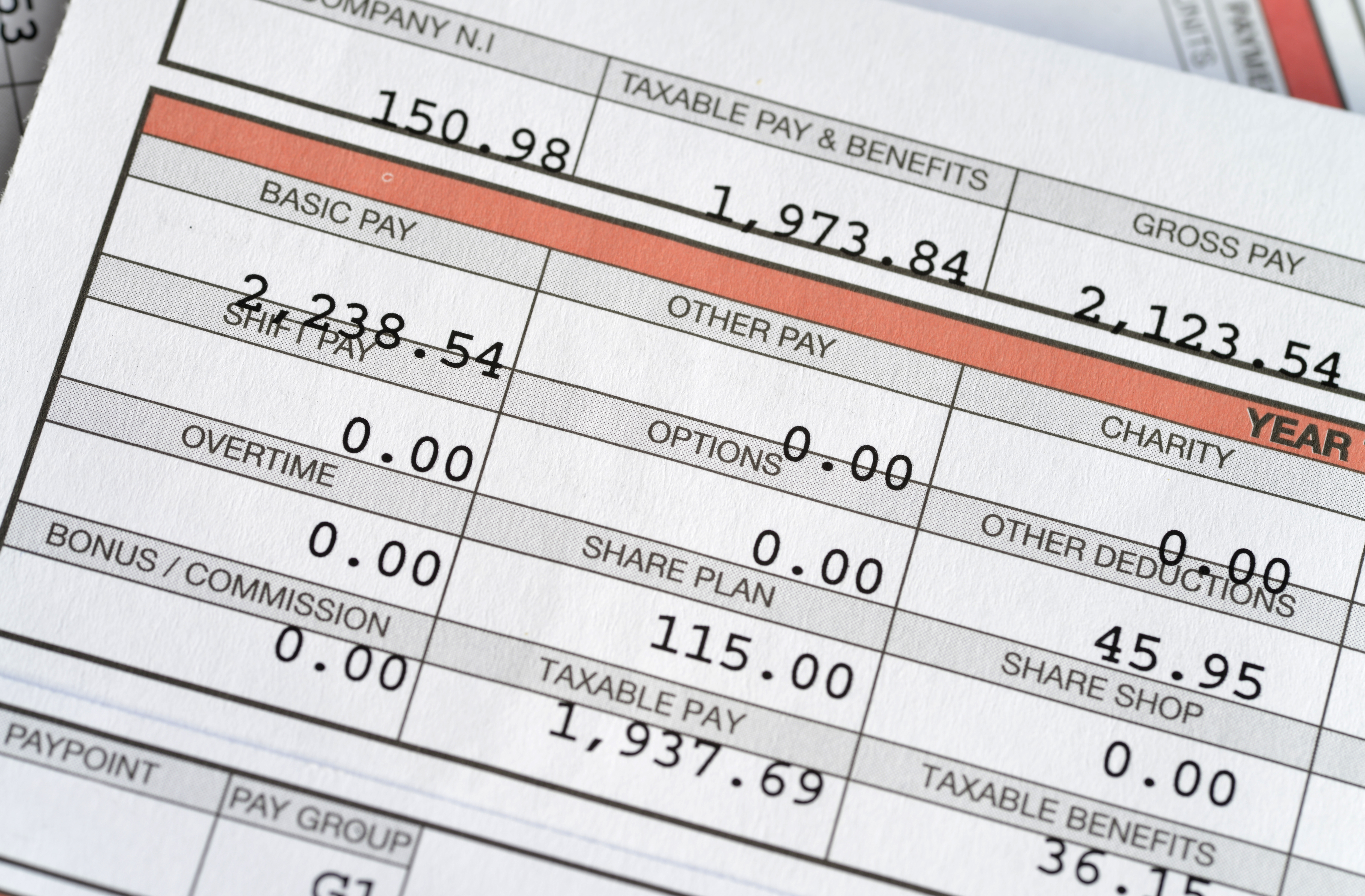

Confirm that the income on the pay stub is correct by asking for a bank statement to cross-reference. This figure should show up on the statement as a deposit, and the deposit should show the name of the company paying them. - Check the decimal point alignment on the pay stub

Accounting software aligns all the digits and decimal points. Thus, if anything is out of place, the paystub is probably fake. This includes the overall look of the document as well. Does it look professional? Is the font and alignment consistent? - Do the math

Check whether the figures on the pay stub add up and that the deductions are correct for your area. Novice scammers don't check the numbers provided on the generators. If you find inconsistencies, then the pay stub is fake. - Is the net income a round number?

A basic mistake that scammers make when generating a fake pay stub is to use round numbers. Paychecks are almost never a rounded number once deductions are taken into account. - Is there missing or incorrect information?

Scammers can forget to correct generic information when faking pay stubs. Make sure that all of the information matches what they've already told you. Missing or inconsistent information such as the applicant’s name, address, company, and other personal information can be a giveaway. The document should also include taxes, insurance deductions, and gross pay.

Spot Fake Paystubs Quickly with Spirited

It only takes a few minutes to create a fake pay stub, but can be very difficult to detect. In contrast to time- and energy-intensive manual inspections, many property owners fight technology-assisted fraud with technology-enabled detection. Instead of spending four to 10 hours vetting an application, they spend minutes uploading digital documentation for image and historical analysis as well as a data-driven review using algorithms tuned to catch document manipulation. Within 24 hours, Spirited certifies whether the documentation is fraudulent or authentic.

Spirited users collectively saved an estimated $15 million in potential eviction costs in 2020. Request a demo today to see how Spirited can work for you.